How Much is 50K a Year Hourly? Unveil the Math!

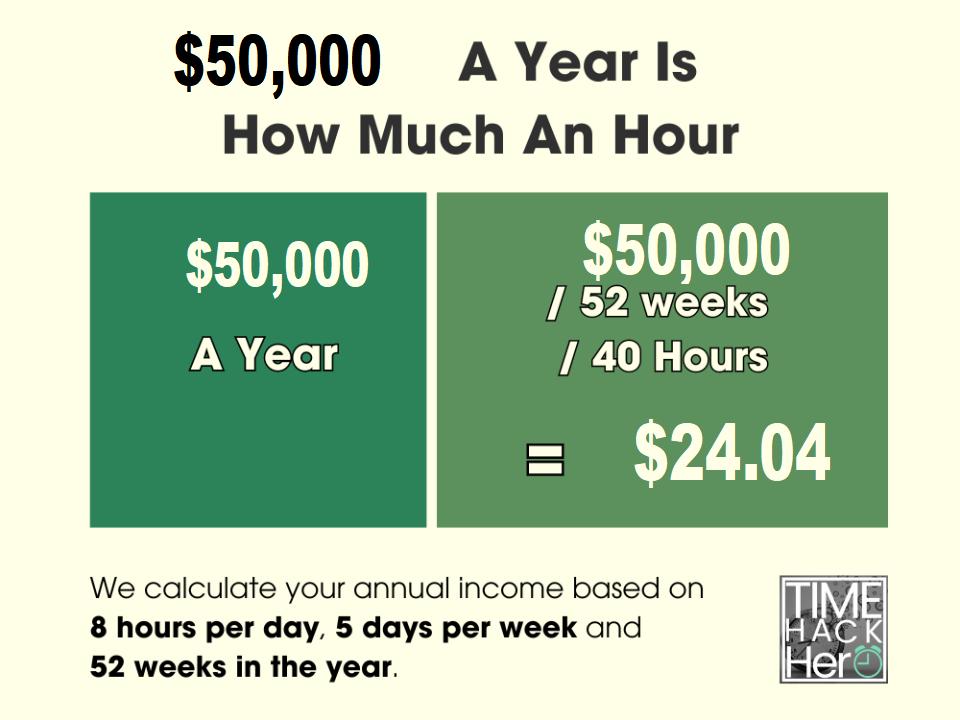

$50,000 a year is equivalent to approximately $24 an hour. This calculation is based on a standard 40-hour workweek.

Are you curious about how much $50,000 a year translates to on an hourly basis? Understanding your annual salary in terms of hourly pay can provide valuable insights into your earning potential. Whether you are budgeting, negotiating a job offer, or simply exploring different income perspectives, converting your yearly income to an hourly rate can be a useful exercise.

Let’s delve into the details of how $50,000 per year breaks down into an hourly wage and how this knowledge can empower you in various financial decisions and considerations.

Breaking Down Annual Salaries

When it comes to understanding your annual salary, breaking it down into hourly rates can provide a clearer picture of how much you earn for each hour worked. Whether you’re curious about your own salary or trying to compare different job offers, converting your annual income into an hourly wage can be a useful exercise.

Salary To Hourly Basics

Converting your annual salary to an hourly rate involves a few key calculations. To begin, you’ll need to determine the number of hours you work in a year. Typically, a full-time position assumes a 40-hour workweek, which amounts to 2,080 hours per year (40 hours per week x 52 weeks).

Once you have the total annual work hours, divide your annual salary by this number to find your hourly rate. For example, if you earn $50,000 per year, the calculation would be as follows:

| Annual Salary | Annual Work Hours | Hourly Rate |

|---|---|---|

| $50,000 | 2,080 | $24.04 |

Based on this calculation, a salary of $50,000 per year equates to an hourly rate of approximately $24.04. Keep in mind that this calculation assumes a consistent work schedule throughout the year and does not account for additional factors such as overtime or benefits.

Annual Work Hours Calculation

Understanding how many hours you work in a year is crucial for accurately converting your salary to an hourly rate. Here is a breakdown of the steps involved:

- Determine the number of hours you work per week. This is typically 40 hours for a full-time position.

- Multiply the weekly hours by the number of weeks you work in a year, which is usually 52.

- The resulting number is your total annual work hours.

For example, if you work 40 hours per week for 52 weeks, your annual work hours would be 2,080 hours.

Credit: www.howtofire.com

The Math Behind 50k A Year

Discover the math behind earning 50K a year by calculating the hourly rate. At 40 hours per week, it averages around $24 per hour, providing a clearer perspective on the value of a $50,000 annual salary.

Calculating Hourly Rate

Calculating your hourly rate from an annual salary of 50K can be a bit tricky, but it’s essential to know how much you’re making per hour, especially if you’re paid hourly. To calculate your hourly rate, divide your annual salary by the number of hours you work per year:

| Annual Salary | Hours Worked Per Year | Hourly Rate |

|---|---|---|

| $50,000 | 2,080 | $24.04 |

So, if you make an annual salary of 50K and work 2,080 hours per year, your hourly rate is $24.04.

Factors Affecting The Math

Calculating your hourly rate based on your annual salary is straightforward, but there are several factors that can affect the math. One of the most significant factors is the number of hours you work per year. If you work more or less than 2,080 hours per year, your hourly rate will change accordingly.

Another factor that can affect your hourly rate is any overtime pay you receive. If you work overtime hours, you’ll need to factor in the extra pay you receive to calculate your hourly rate accurately.

Finally, taxes can also affect your hourly rate. Your take-home pay will be less than your gross pay due to taxes, which means your hourly rate will be lower than expected.

Knowing how to calculate your hourly rate based on your annual salary is crucial for understanding your income and negotiating your pay. By taking into account factors like the number of hours you work, overtime pay, and taxes, you can get a more accurate picture of your hourly rate and make informed decisions about your finances.

Full-time Versus Part-time Perspectives

When considering a salary of 50K a year, it’s essential to understand the hourly rates for both full-time and part-time employment. Depending on the number of hours worked per week, the hourly rate can vary significantly. Let’s explore the hourly rate for full-timers and the salary conversions for part-time workers.

Hourly Rate For Full-timers

For those working full-time, a 50K annual salary translates into an hourly rate that can be calculated based on a standard 40-hour workweek. To determine the hourly wage, divide the annual salary by the number of weeks in a year:

Hourly rate for full-timers = Annual salary / (52 weeks 40 hours)

By plugging in the numbers, we can calculate the hourly rate:

| Annual Salary | Hourly Rate |

|---|---|

| $50,000 | $24.04 |

Therefore, full-time employees earning 50K a year have an hourly rate of approximately $24.04.

Part-time Salary Conversions

For those working part-time, the calculation of the hourly rate is slightly different. Since part-time schedules can vary, it’s crucial to determine the number of hours worked per week to accurately convert the annual salary to an hourly rate.

To calculate the hourly rate for part-time workers, divide the annual salary by the number of weeks in a year and then divide it by the number of hours worked per week:

Hourly rate for part-timers = Annual salary / (52 weeks hours worked per week)

Let’s consider a few examples:

- If a part-time employee works 20 hours per week:

| Annual Salary | Hours Worked per Week | Hourly Rate |

|---|---|---|

| $50,000 | 20 | $48.08 |

- If a part-time employee works 30 hours per week:

| Annual Salary | Hours Worked per Week | Hourly Rate |

|---|---|---|

| $50,000 | 30 | $32.05 |

- If a part-time employee works 35 hours per week:

| Annual Salary | Hours Worked per Week | Hourly Rate |

|---|---|---|

| $50,000 | 35 | $27.21 |

These examples illustrate how the hourly rate for part-time employees can vary based on the number of hours worked per week. It’s important for part-time workers to calculate their hourly rate to better understand the value of their salary.

Credit: timehackhero.com

Tax Considerations

When it comes to understanding your income, it’s important to take tax considerations into account. Knowing how much of your earnings will be deducted for taxes can help you plan your budget and make informed financial decisions. In this section, we will explore the pre-tax hourly earnings and after-tax take-home pay when earning $50,000 a year.

Pre-tax Hourly Earnings

Before diving into the after-tax take-home pay, let’s first calculate the pre-tax hourly earnings. To do this, we divide the annual salary of $50,000 by the number of working hours in a year. Assuming a standard workweek of 40 hours and 52 weeks in a year, the calculation would be as follows:

| Annual Salary | Number of Working Hours | Pre-Tax Hourly Earnings |

|---|---|---|

| $50,000 | 2,080 (40 hours x 52 weeks) | $24.04 |

Therefore, the pre-tax hourly earnings would be approximately $24.04.

After-tax Take-home Pay

Now let’s move on to the after-tax take-home pay, which is the amount you receive in your bank account after taxes are deducted. The exact amount will depend on various factors, including your filing status, deductions, and credits. However, we can estimate your after-tax take-home pay based on average tax rates.

To provide a general idea, let’s assume a 20% average tax rate. This means that approximately 20% of your pre-tax earnings will be deducted for taxes. Applying this rate to the pre-tax hourly earnings of $24.04, we can calculate the after-tax take-home pay as follows:

| Pre-Tax Hourly Earnings | Average Tax Rate | After-Tax Hourly Earnings |

|---|---|---|

| $24.04 | 20% | $19.23 |

Therefore, with a 20% average tax rate, your estimated after-tax take-home pay would be approximately $19.23 per hour.

Remember that these calculations are general estimates, and your actual after-tax take-home pay may vary based on your individual circumstances. It’s always advisable to consult with a tax professional or use tax software to get a more accurate understanding of your specific tax situation.

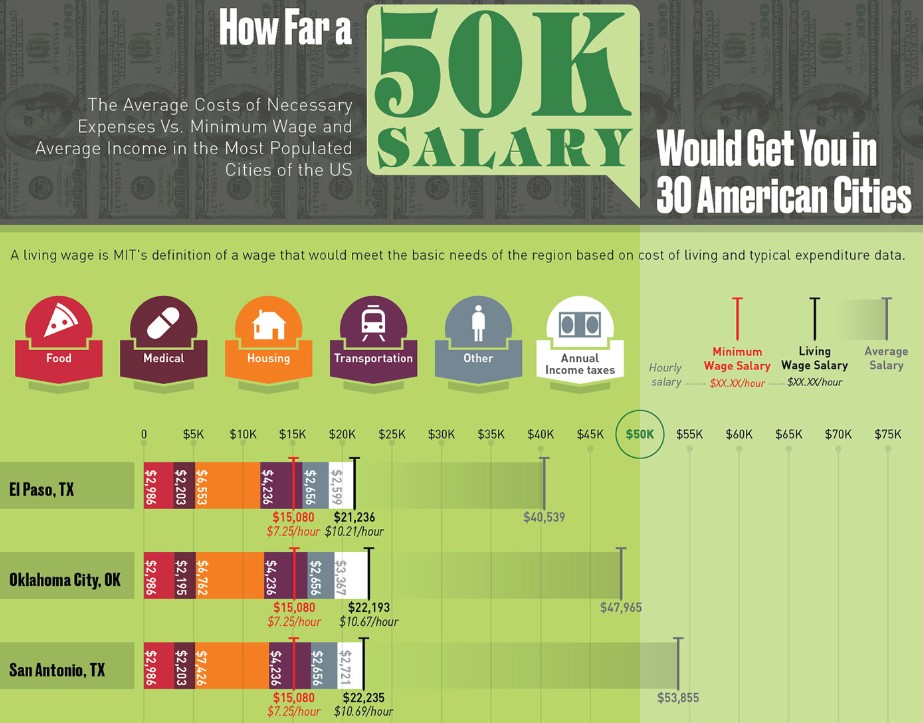

Comparing To National Averages

When it comes to comparing a $50,000 annual salary to national averages, it’s essential to consider the variations in cost of living and industry standards across different regions. Understanding how this income compares to the average hourly rate in various areas and industries can provide valuable insight for individuals evaluating their earning potential and financial stability.

50k In Different Regions

Considering the cost of living across different regions is crucial when evaluating the purchasing power of a $50,000 annual salary. Here’s a breakdown of how this income translates to hourly earnings in some major U.S. regions:

| Region | Average Hourly Earnings |

|---|---|

| New York City | $24.04 |

| San Francisco | $26.92 |

| Los Angeles | $23.08 |

| Chicago | $21.15 |

Industry Standards

Furthermore, the industry in which one works also significantly impacts how a $50,000 annual salary stacks up against average hourly rates. Here’s a glimpse of how this income compares to hourly earnings in different industries:

- Healthcare industry: $24.00 per hour

- Information technology: $27.50 per hour

- Retail sector: $18.75 per hour

- Manufacturing industry: $21.25 per hour

Credit: www.titlemax.com

Budgeting On A 50k Salary

When it comes to budgeting on a 50K salary, it’s important to have a clear plan in place to make the most of your income. By breaking down your monthly budget, implementing saving strategies, and being mindful of your spending, you can effectively manage your finances and work towards your financial goals.

Monthly Budget Breakdown

Creating a monthly budget breakdown is essential for effectively managing a 50K salary. By allocating specific amounts to different expense categories, you can ensure that your income is being utilized efficiently.

Saving Strategies

Implementing saving strategies is crucial for making the most of a 50K salary. By setting aside a portion of your income for savings and investments, you can build a financial safety net and work towards achieving long-term financial stability.

Negotiating Salaries

Knowing Your Hourly Worth

Understanding your hourly worth is essential in negotiating salaries effectively.

Tips For Salary Negotiation

- Research industry standards

- Highlight your skills and achievements

- Be confident but respectful

- Consider non-monetary benefits

Career Paths And 50k Potential

Exploring different career paths can lead to a 50K salary, offering diverse opportunities for growth and advancement.

Jobs That Offer 50k

Various careers can lead to a 50K salary, including:

- Graphic Designer

- Registered Nurse

- Web Developer

- Electrician

Growing To A 50k Salary

To grow your income to 50K per year, consider advancing your skills, seeking promotions, or exploring new job opportunities.

Frequently Asked Questions

What Is The Hourly Rate For A 50k Annual Salary?

The hourly rate for a $50,000 annual salary is approximately $24. 04, based on a standard 40-hour workweek. This calculation provides a helpful insight for individuals seeking to understand the equivalent hourly wage for a given annual income.

Is A 50k Salary Enough To Live On Comfortably?

A $50,000 salary can provide a comfortable living depending on the cost of living in your area and your personal financial situation. It’s important to create a budget and consider factors such as housing costs, utilities, and other expenses when evaluating the adequacy of a salary.

How Does A 50k Salary Compare To The National Average?

A $50,000 annual salary compares favorably to the national average income. It offers financial stability and the ability to cover essential living expenses. However, regional cost variations may impact the overall purchasing power and standard of living associated with this salary level.

Conclusion

Determining the hourly wage for a $50,000 annual salary requires a bit of math. It’s important to consider factors such as the number of hours worked per week and the number of weeks in a year. Additionally, it’s crucial to factor in any additional benefits or bonuses that may be included in the annual salary.

By calculating these variables, individuals can gain a better understanding of their true hourly wage and make more informed financial decisions. Remember, it’s important to regularly evaluate and negotiate salaries to ensure fair compensation.